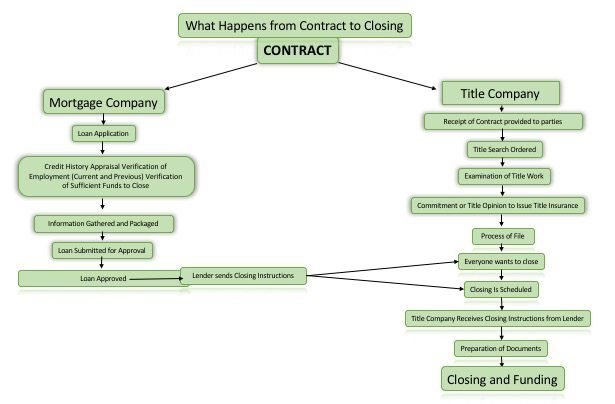

It’s exciting to reach the end stages of buying or selling a home, but navigating the closing process can be complicated. Here are the steps that will be taken to ensure that your experience is as easy and streamlined as possible.

The Closing Process

What Happens After an Offer is Accepted?

Step 1: Delivery of the Contract

Once the contract is signed and accepted by the buyer and seller, it’s brought to the closing or escrow agent, along with a copy of the earnest money check. The closing agent then starts the closing process by:

- Opening a title order and file

- Ordering a title search with an insured abstractor or attorney

- Moving the file to a processor in preparation for closing

Step 2: Title Search and Examination

In order to execute and deliver a title search, the public records of your intended property are accessed at the Register of Deeds office in the county where the purchase is being made. The records that will be searched include deeds, mortgages, liens, wills, divorce settlements, and more.

After the search is completed and received by the closing agent, an examination is carried out to determine legal ownership, debts owed, and whether there are any liens in place (and if there are, whether they belong to the buyer or seller). Once the search and examination are both complete, a title commitment or preliminary title opinion by an attorney is prepared and sent out.

Step 3: Closing the File

Following the title examination process and receipt of the results, the processor will contact both the listing agent and selling agent for information – including contact information for their clients – that will help the closing agent prepare closing documents and a statement. A checklist may be emailed to the buyer and seller with a list of any remaining items needed to complete the process. During this stage, the title company will contact all parties to schedule and confirm a closing date, time, and location.

Step 4: Document Preparation

During this part of the contract to closing timeline, all documents received from the lender will undergo a final review, with additional documents prepared if called for, so that they can be signed and notarized after the following tasks are accomplished:

- The closing agent receives closing instructions or a closing disclosure from the lender

- The agent prepares a final closing statement that includes a list of fees, charges, and pro-rations associated with closing, along with bottom line amounts due from the buyer and seller at closing

Step 5: Closing on a Home

Prior to signing, the closing agent will go over the documents with each party, if needed, before the escrow or settlement agent oversees the conclusion of the real estate sale. The necessary documents will be notarized and copies of everything you sign will be given to the buyer, seller, and any agents involved. Disbursement will also take place at closing.

Step 6: Post-Closing Documents

Once closing is finally complete, there are only a few more issues of business to take care of.

- The escrow or settlement agent, or closing company, will forward payment to any involved parties, if they haven’t received or collected payment yet

- The original signed lender documents are sent back to the lender for final review

- The deed and mortgage are sent to the Register of Deeds office to be filed in the county where the property is located

- Title insurance policies are prepared and sent to the lender and new owner within 30 days of closing

Be Prepared

At closing, both buyer and seller should bring identification. This must be valid and have both a photo and signature. Additionally, the buyer and seller may need to provide sufficient funds in the form of wire transfer or cashier’s check payable to Title One. The closing company will contact you with the necessary amount, along with wiring instructions.

At Title One, we respect the privacy of our clients and will never provide any of your personal information without permission.